Our first target of the "52-Week Lows" series, where we’ll be analyzing stocks exclusively from the WSJ’s “52-Week Lows” section, is Taylor Devices (TAYD 0.00%↑), a $30M market cap company with a fascinating history. Founded in 1955, Taylor Devices began dabbling in suspension products in the aerospace and defense industry. Fast forward two decades, they produced several major products for NASA's Apollo and the Space Shuttle program. Its main products were a damper and shock absorber that had to slow down the fast-moving swing arm of the space shuttle structure as well as crane buffers for industrial use, but by the 1980s, buffer sales were stagnating.

In 1993, shifting their focus to commercial applications of their technologies, Taylor Devices ended up in the seismic dampers markets for the construction industry. Today, they serve three distinct segments: Aerospace, Infrastructure, and Industrial. You can find Taylor Devices' products in over 750 structures worldwide, from buildings to bridges to hotels and airports.

Taylor Devices sell its products through 3 segments: Industrial, Structural, and Aerospace/Defense. The Industrial products include crane buffers, dampers and shock absorbers, and liquid die springs, while the Aerospace segment consists of isolation systems, landing gear, machine springs, and even custom applications. A not as significant part of the revenue composition, the Structural segment consists primarily of buildings and bridges.

Honestly, this is not a stellar company when you look at the income statement. Credit where credit is due, though; Taylor Devices has stood the test of time, weathering various economic storms as a public and private company. As such, they tend to generate positive free cash flow yearly. Emphasis on the word "tend" as they've had their share of reasonably recent quarters running at an operating loss (that's why the company is so cheap). The point is that as long as they don't destroy shareholder value by continuously losing money, we should be good for reasons we'll get to in a minute.

From 2016-2021, the peak cycle revenue was 2016 at $35.7M, while the low was 2021 at $22.5M. It's important to note that TAYD's fiscal year ends in May, so the five-year low was right in the middle of the lockdowns (May 2020-May 2021).

If we average out the 2016-2021 revenues, gross margins, and operating margins, we arrive at:

Revenue: $28.35M

Gross Margins: 27.33% → $7.75M

Operating Margins: 6.72% → $1.91M

These numbers provide a guideline, never a hard target. In any case, if we look, there is no consistency between the years, indicating they are in a cyclical industry; in this case, Taylor Devices are highly sensitive to the construction and aerospace cycles.

Okay, now that we got the introductions out of the way, let's get to the real reason we are discussing why it may be a good idea to park one's money in Taylor Devices: margin of safety. Even doing all that fancy math, we Bottom Fishers have no magic ball to see the future. We have absolutely no confidence in our forecasting abilities, so for us, the margin of safety is explicitly derived from the balance sheet. We are value traders, after all.

Let's start with opening up the balance sheet. TAYD has no long-term debt and $4.5M in total liabilities compared with $21.25M and $34.74M in cash and current assets, respectively (thanks PPP loan and Covid-19 increased spending). Net of debt, we are looking at $4.63 per share in cash and $8.46 per share in current assets. That's right, you are getting the business at the value of its cash, accounts receivable, and inventory—a good deal without consideration for its PPE and earnings power.

Thinking backward, this company is much cheaper than in the last five years. It traded at a cash multiple of 30.8x, 3.3x, 2.5x, and 1.85x in 2019, 2020, 2021, and LTM, respectively, and on a current assets multiple of 1.5x, 1.22x, 1.4x, 1x in 2019, 2020, 2021, and LTM. If we exclude the outliers (2019 cash multiple) and average the multiples, we can arrive at a target price (am I confident in this price target? Heck, no! But I've found it good for investing psychology). These are the multiples we end up with:

Cash (2020, 2021, and LTM): 2.4x → $11.06 (30.1% upside)

Current Assets (2019, 2020, 2021, and LTM): 1.21x → $10.3 (21.7% upside)

Playing devil's advocate, if price drops to 1x cash → $4.63 (45% downside)

So, one question we should take the time to ask here is, "If this stock falls by 50%, what would we do?" (credit to Guy Spier's checklist…) The answer is simple: as long as there's no bankruptcy risk, we should add more at a discount to asset values and wait for the market to expand the balance sheet multiples again.

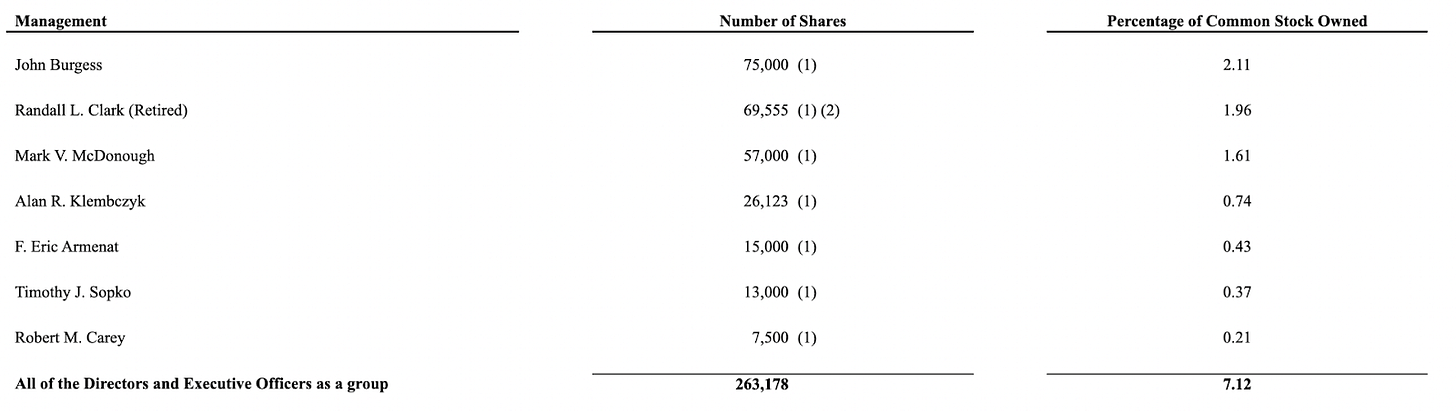

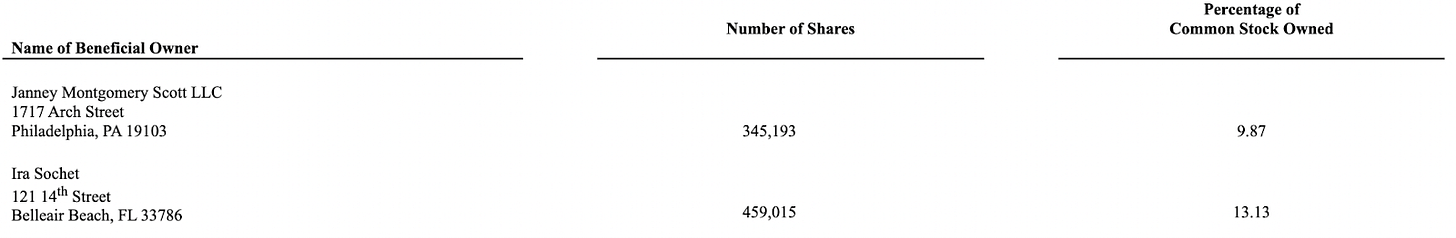

Moving on to the people responsible for expanding the multiples: management. This company does not say why they hoard so much cash. They don't pay dividends or repurchase any significant shares; they keep collecting that cash and putting it in the vault. The only way for management to increase shareholder value is through stock price appreciation. Thankfully, they're incentivized to be on the side of the shareholder through stock options and insider ownership.

As of May 2021, insiders owned 7.12%. Since then, 7,000 shares were bought in the open market by the CEO and CFO at a weighted average price of $9.11 ($63.82K).

In addition, 94% of stock options have a strike price above the current share price.

As a bonus, here's how much management makes because we are a nosy bunch. What stands out is that even though this company feels like its management's cash cow, the reality is that since Taylor Devices did not have a good FY21, they did not receive a bonus.

As you find out management is entitled to 15% of net income (as executive compensation), one can't help but think management has a sweetheart deal here. But for our purposes, that's beside the point. As stated before, as long as management doesn't destroy shareholder value, the higher the likelihood of multiples expanding or assets increasing.

Great! We now have a few reasons for investing in this stock. Now, our job of looking for a reason not to buy the stock begins. If management is aligned and there's asset-based downside protection, what could be why putting money into this idea would not be recommended?

The first reason would be inflation's impact on this business by increasing its COGS. Is this the new normal for Taylor Devices? Will they have to tap into their coffers to be able to run the business? We can't act surprised if this hurts the investment thesis.

A second reason would be that the largest four customers represent over 30% of total sales. Losing even one could impact the operating numbers. On the other hand, as of February 2022, the company had 140 orders in backlog, accounting for $17.4M, while $4.7M of the current backlog is "projects in progress."

A third reason is that management has put specific mechanisms in place to avoid a takeover, reducing value unlocking catalysts. As of 2018, the company adopted a plan that if a person acquired more than 15% of shares outstanding or if a person commenced a tender offer for more than 10% of shares outstanding or if the board determines a >10% owner takes a coercive and hostile approach, the companies shareholder we'll be able to exercise a right to buy preferred stock and dilute existing shareholders.

We also have the fact that this is a substantially illiquid stock, trading 2,000 shares per day (or $17,000). It is not a stock for the medium-large investor. Based on its illiquid nature, one must consider portfolio management and trading considerations. If one were to add this stock to a portfolio, it would be complicated to sell out of it if push comes to shove. As such, a sizable portfolio allocation is not prudent, while discount cost averaging is; carefully accumulating a position.

To conclude, the investment thesis is clear: buy the business at a low price relative to assets and wait for the earnings cycle to return. The stock price should appreciate as soon as this company shows continued profitability. The few reasons to sell this investment are twofold: if the company continues to lose money and destroy equity and if the company begins diluting shareholders. We assign the latter a small probability.

Another question we should consider before starting a position is: "is the reward good enough to warrant locking up capital for what could be years?" Well, unfortunately, we can't help you on that one. That is a question for each investor to answer on their own.

In our view, while we already established that we would buy more if the price got slashed in half, due to the business's cyclicality and current market sentiment, there's a good chance this stock continues heading downwards.

In other words, for us, the risk-reward is not as attractive to warrant an immediate purchase. One risk that keeps us from recommending a buy is the possibility of this trade taking more time than expected since there is no hard catalyst. Because of this, we will wait for the FY report to be released next week. It should provide a good view of where the business is heading and its capital structure.