Founded in 1962, Kforce has transitioned from a general staffing agency to focusing on supplying workers with in-demand technology skills. Catching this tailwind has fueled revenue and net income growth over the past five years. No doubt Kforce was a pandemic over-earner as technology firms overinvested in human labor the past two years, and now the question is whether this business is sensitive to the cyclicality of the business cycle. In other words, is the business resilient enough to withstand an economic downturn, or will it revert to its mean, giving back the growth it has experienced? Will demand for tech labor continue its exponential growth, or will it dwindle?

Let’s start by discussing the business dynamics. let’s say a company such as Microsoft comes to Kforce needing assistance finding help for a short-term consulting project of 3 months. Kforce comes to a payment agreement with Microsoft for the length of the project and begins to search their databases for a qualified individual. The individual would then begins to work while Kforce is the one responsible for the payroll, taxes, and other back-office tasks. Kforce profits by taking a fee from the employee's salary. In effect, Kforce and other staffing agencies provide a “win” for the client company and a “win” for the job seeker.

The key driver for this company’s earnings is the demand for tech workers, followed by the availability of tech workers. This two have a reflexive nature: the more demand for tech roles, the more people will learn the skills. Looking back to 2020-2021, the demand was palpable, but will it continue in the future? The increasing digitalization of businesses should aid the demand for technological staff, and the rate at which these skills are being learned as career skills is exorbitantly high. But, how can we be sure that the result of 2020 and 2021 did not “pull forward” years of demand in advance? If that’s the case, what of it? Is there room to go? Unlike the stock market, where people are drawn in with the bull markets and become disinterested as a bear market progresses, tech demand should not be as cyclical. Start-up multiples and funding could very well be a fraction of the past few years, but it would be extremely presumptuous of us to bet against human innovative efforts.

Earnings and Free Cash Flow

With a market cap of $1.065B and an LTM net income of $90M, KFRC is trading at 11x earnings. If we assume that the business will suffer from cyclicality, we could say that in the worst case, Kforce has the ability to generate around $50M in net income annually. If we do the same “doomsday scenario” for the FCF, we see that Kforce can consistently make over $40M in FCF annually with minimal CapEx. So they are profitable, but how have they returned this capital to shareholders? Well, through a combination of debt repayments, repurchase of common stock, and good ol’ fashion dividends. Kforce currently offers a stead $1.14 dividend per share or a yield of 2.11% at a share price of $54. With a dividend expense of $24M, if push comes to shove, they can easily forego other actions to pay their dividend obligations. Due to the risk of this being a cyclical company regarding its earnings power and free cash flow generation, we take a conservative measure. In effect, at $50M net income and $40M FCF, we would be buying this issue at over 20x earnings and FCF multiples. It’s more expensive than what we are used to analyzing, but if this business can show continued growth in the long term (3-5 years), it’s by no means an absurd price to pay.

Balance Sheet

The silver lining is that they used the increased business of the past few years to strengthen the balance sheet. The company paid in full all their long-term debt obligations, and now has $5 per share in current assets net of liabilities and $10 of book value per share. To be perfectly honest, it’s not a great margin of safety if we take the numbers without context. Since 2014, this company has constantly traded between 3x to 5x book value. With a share price of $54, we are currently at the upper bounds of the range. On the other hand, Kforce has seen its accounts receivable increase over the past years, yet it’s receivables turnover ratio has stayed pretty much constant. That leads us to the conclusion that business is still growing while they have not had any more difficulty turning the receivable into sales.

Management

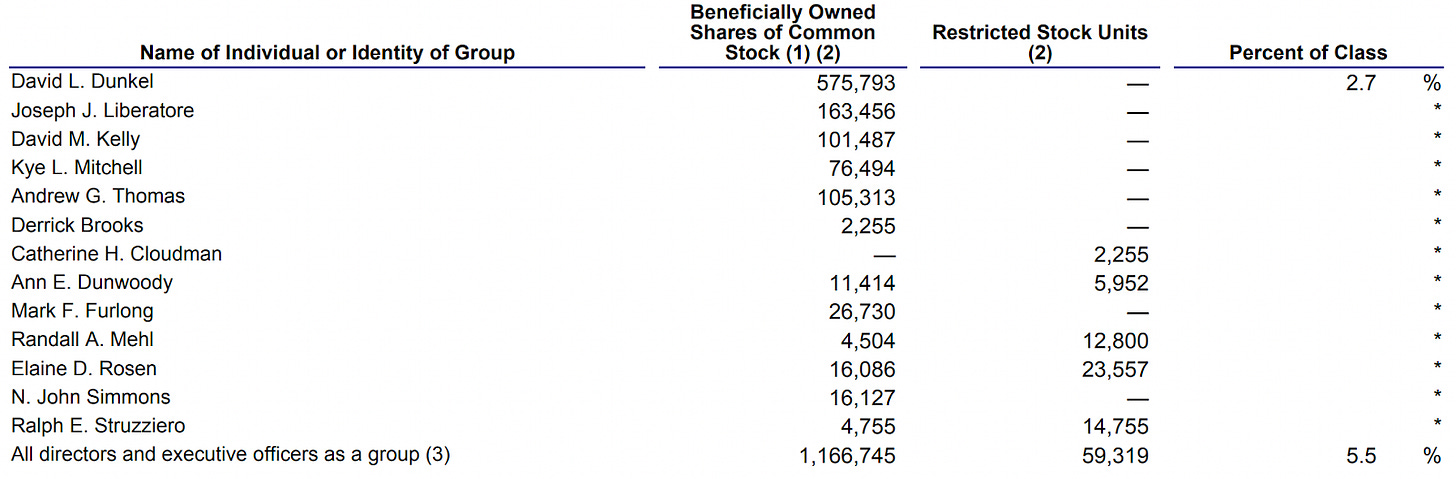

Kforce had a leadership change beginning in 2022 when long-time CEO David Dunkel ceded the post to Joseph Liberatore. Liberatore has been with the company for almost three decades and has been in most leadership positions, telling us he has ample understanding of the business. Over the years, he served as chief sales officer, chief talent officer, and chief financial officer in addition to overseeing the transition towards more of a digital staffing agency.

Insider ownership is not out of this world, and bonuses are dictated by revenue and EPS growth, which is intuitively good for small shareholders. Kforce awards stock to its employees, but we would like to see open market purchases instead of restricted stock awards. In fact, there haven't been any open market purchases in the last year or so.

Verdict

Kforce is a well-managed company with a long history of navigating turbulent markets accompanied by outsized shareholder returns. There are a lot of unknowns currently circling the macro landscape that could affect earnings both positively and negatively, but if we look solely at what we are getting for at current prices, we arrive at the conclusion that Kforce is still an overvalued issue. Based on its earnings power and free cash flow generation, we see it as somewhat attractive, but the small margin of safety in regard to its balance sheet makes it especially prone to falling an additional 30%. That said, we would be incredibly interested in this stock if it goes below $40, which would be closer to its historical book value multiple.

Have you guys abandoned your research? You've discovered some winners. Keep digging !!